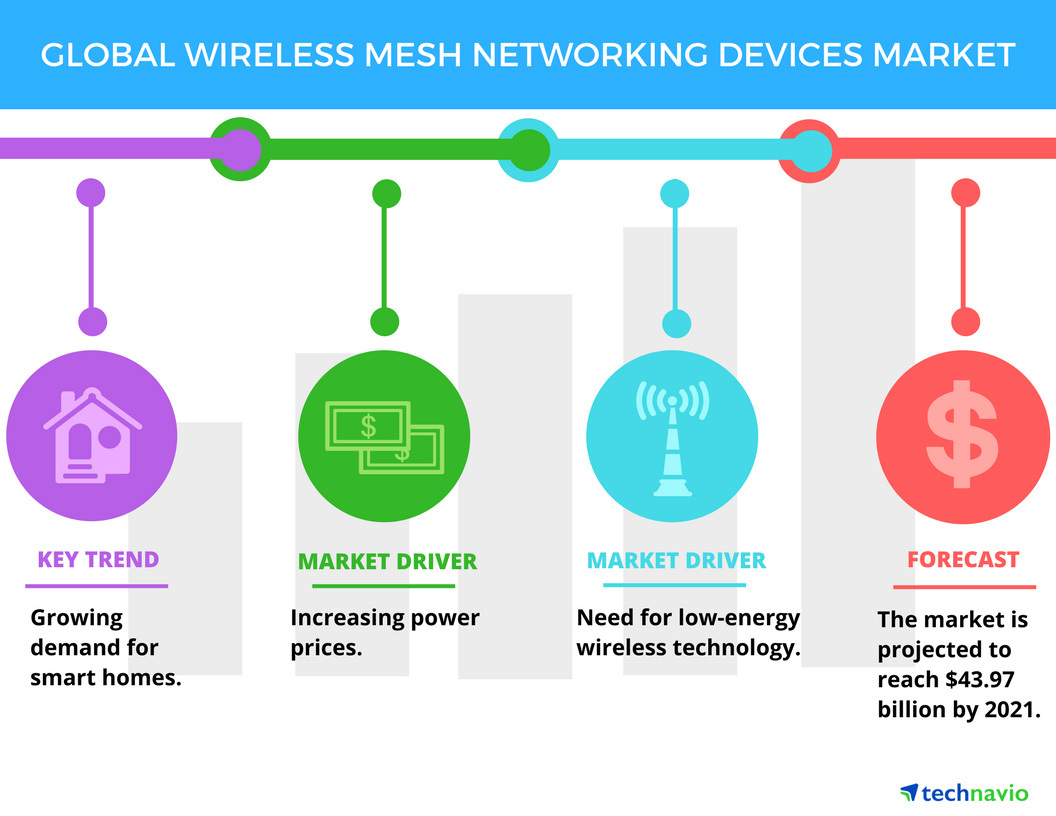

Wireless mesh networking devices market to grow at almost 9% a year until 2021, says Technavio

Technavio analysts forecast the global wireless mesh networking devices market to grow at a CAGR of almost 9% during the forecast period, according to their latest report.

The research study covers the present scenario and growth prospects of the global wireless mesh networking devices market for 2017-2021. The market is segmented based on application (STBs, smart metres, and remotes) and geography (the Americas, EMEA, and APAC).

In 2016, the majority of the revenue growth in the market was driven by Set Top Boxes (STBs), which accounted for more than 69% of the mesh network-enabled devices market in 2016. This is because mesh network-based STBs can act as central routing systems for other mesh network-based devices.

These STBs act as a central co-ordinator by creating a mesh network, through which the connected devices in the smart home can communicate with each other. Another major segment that is predicted to drive the market is smart metres. The governments and utility companies are taking initiatives to conserve energy by implementing smart metering solutions.

This report is available at a USD 1,000 discount for a limited time only: View market snapshot before purchasing

Technavio hardware and semiconductor research analysts highlight the following three factors that are contributing to the growth of the global wireless mesh networking devices market:

- Rising power prices

- Growing membership of ZigBee Alliance

- Emergence of various ZigBee standards to support IoT devices

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Rising power prices

The global demand for electricity has been growing continuously as a result of widespread industrialisation, surging populations, rising numbers of the middle class, and growing energy consumption worldwide. The prices of raw materials used by power generation and distribution companies have risen sharply, forcing power producers to increase electricity prices in a bid to maintain operations and secure profits.

Raghu Raj Singh, a lead embedded systems research analyst at Technavio, says, “Electricity charges account for a huge part of consumers’ monthly utility bills, and so homeowners need to minimise energy consumption to reduce costs.

Smart connected devices assist users to remotely monitor appliances to help conserve energy. These devices also master consumer behavior through self-learning algorithms and adjust energy consumption accordingly, thus conferring monetary savings on users.”

Growing membership of ZigBee Alliance

As the IoT market is growing at a rapid pace, the demand for connected devices is on the rise, which is encouraging organizations from several industries to join ZigBee Alliance that provides global wireless standards. ZigBee Alliance allows member companies to develop interoperable products supporting different ZigBee profiles.

“The growing membership in ZigBee Alliance will aid in leveraging the expertise of member companies to develop standards, increase awareness, understand ZigBee technology, and ensure interoperability across the IoT devices, and thus drive the growth of the global wireless mesh networking devices market,” added Raghu.

Emergence of various ZigBee standards to support IoT devices

New ZigBee standards have emerged to address the need of connecting several products such as gateways, home appliances, and entertainment systems for smart homes, sensors, and STBs with a common wireless standard that provides interoperability with the widest range of smart devices.

ZigBee 3.0 standard can be used in devices having no batteries by virtue of its Green Power option. For instance, light switches utilise the energy generated by flipping a switch for turning on and turning off the light. ZigBee had been through testing; many ZigBee alliance members that include The Kroger, Legrand, NXP, Philips, Schneider Electric, Silicon Labs, Texas Instruments, Wincor Nixdorf, and V-Mark participated in the developing and testing process.

Top vendors:

- Atmel

- Digi International

- NXP Semiconductors

- Renesas Electronics

- Silicon Laboratories

- STMicroelectronics

- Texas Instruments

Comment on this article below or via Twitter @IoTGN