Cellular IoT MVNOs to manage 670mn connections by 2026

Steffen Sorrell of Kaleido

London, UK. 26 April 2022 – Kaleido Intelligence, a connectivity market intelligence and consulting firm, has found that cellular IoT connections managed by MVNOs will reach 670 million in 2026, growing at a CAGR of 24% between 2022 and 2026. Notably, with many IoT MVNOs now specialising in eSIM solutions, Kaleido predicts that eSIM connection growth for these players will outstrip overall connection growth to 2026, growing at 42% CAGR to reach 447 million connections in the latter forecast year.

Kaleido’s new IoT MVNO Tracker: Connectivity & VAS 2022 research found that Europe and Asia-Pacific will account for just under 50% of total connections in 2026, with the latter region growing at an average annual growth rate of 30%.

Aeris, KORE and Truphone lead connection market share

While there are a significant number of IoT MVNOs providing services on the market, Kaleido’s research has found that the top 10 players analysed in the tracker made up 68% of the total connection volume in 2021, as well as 71% of the global revenue share.

Meanwhile. the top 3 IoT MVNOs on the market: Aeris, KORE and Truphone, accounted for 28% of global IoT MVNO connections in 2021.

Steffen Sorrell, chief analyst at Kaleido, commented, “It is notable that the top IoT MVNOs on the market have developed highly flexibly connectivity solutions to support a variety of business requirements. These include dedicated IoT core network infrastructure, eSIM connectivity bolstered by multi-IMSI technology to optimise coverage and lower costs, in addition to specialisation in a vertical or service area, such as healthcare, or eSIM Remote Subscription Management.”

Intense competition to drive IoT MVNO innovation

Kaleido found that the IoT MVNO market remains intensely competitive and predicts that players that remain focused on a pure connectivity play will likely lose out to more innovative service providers. This is, in part, due to shifts in the wholesale market which mean that IoT MVNOs are less able to be competitive in pricing than in former years.

Innovative IoT MVNOs are now integrating differentiated services into their offering, such as device management capabilities, advanced security solutions, Private LTE or 5G as-a-service portfolios. In addition to this, they offer orchestration layer capabilities underlying their connectivity management platforms to streamline operations on behalf of customers. These elements are likely to drive ARPU levels higher, to offset ever-falling connectivity costs. Overall, Kaleido predicted that IoT MVNO connectivity management and VAS revenues will close in on $9.1 billion (€8.58 billion) in 2026, representing a 22% CAGR between 2021 and 2026.

![]()

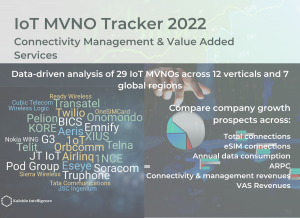

The research has analysed 29 leading IoT MVNOs offering Connectivity & VAS. It includes an in-depth evaluation of vendor performance across 12 verticals, including connections, average revenue per connection, eSIM connections, data consumption and revenues derived from connectivity services and VAS.

Comment on this article below or via Twitter @IoTGN