Untethered ‘hearable’ technologies offer new monetisable opportunities, say analysts

A hearable is defined as an intelligent in-ear audio product that uses wireless technology to connect via a smartphone or other device that streams content from the Internet. Hearables improve the listening experience through application of noise cancellation and audio enhancement technology, or through advanced features such as translation and voice assistant integration. Unlike headphones, hearables are designed to be worn comfortably even when no content is being consumed.

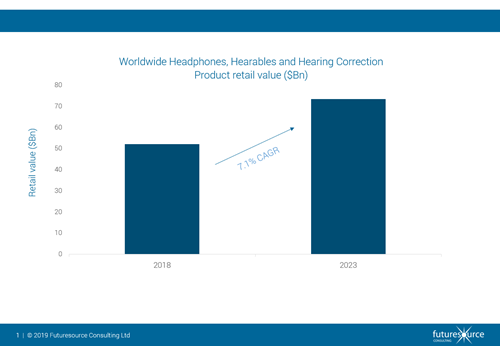

The worldwide forecast for hearables, headphones and hearing correction products is positive, presenting a market with a combined retail value of over $73 billion by 2023. The thirst for technology integration, notably voice assistants, exhibits potential to build a unique class of innovative hearable products.

The anticipated cross-over with hearing aids creates an opening for a new range of “smart hearable” products, able to amplify and enhance speech whilst filtering out ambient background noise. Meanwhile, changes in US regulation next year will permit a new category of over-the-counter hearing correction products. Though it’s too early to speculate on what may be permitted under the new regulations, this may widen the market to a broader range of hearables.

Progression beyond the current tethered hearable form factor must happen to enable more advanced use cases; moreover, the migration to 5G mobile communication presents opportunity for a new category of “standalone” untethered hearables that are directly connected to the Internet. The deployment of 5G networks will significantly improve the reliability of mobile data transmissions whilst massively increasing capacity, paving the way for data-intensive applications. Similarly, the network densification required to deliver high-bandwidth 5G communications will enable standalone hearables with “always on” connectivity and cell-based location services.

The technology integration required to build standalone hearables presents several challenges. The restrictive size of the earpiece means that physical constraints apply to the electronics; likewise, smaller batteries lead to issues concerning usability and longevity. For cellular-enabled 4G and 5G devices, the option to employ eSIM and iSIM (integrated SIM) technology reduces the burden on hearable form factors, removing the necessity for a physical SIM card and leaving space for the modem and antennas.

Meanwhile, advances in system-on-chip (SoCs) designs targeting hearables will tighten the integration of sensors and cellular communications technology whilst simultaneously reducing power consumption, presenting a package of essential components on a single silicon chip. In the interim, charging cases will likely become a home for additional electronics and communications technology, with advantages of a larger battery and freeing designers from the constraints of the earpiece.

Standalone hearables offer an exceptional opportunity for a highly personalised voice assistant with a unique ability to directly communicate with the user. Indeed, the next generation of products are likely to harness machine learning to ascertain the user’s preferences, habits and behaviour in order to engage more personally on a one-to-one level.

Coupled with location-based awareness via an on-board GPS, spoken direction will become an essential skill for hearables, well beyond the “command and control” voice interface we have today, capable of directing users through spoken step-by-step instructions. Furthermore, this creates entirely new channels for monetisation, since advertisers will be quick to harness opportunity to speak to wearers, conveying precisely timed and relevant information based upon geolocation.

Beyond this, a new concept of “audible AR” will likely evolve, presenting a market for advanced hearables that overlay spoken information to augment the real-world environment in real-time. Voice assistants will no longer remain quiescent until summoned by the user; instead they will intelligently interject at optimum moments throughout the day, influencing the user’s thoughts and behaviour.

Internet giants will need to reconsider existing business models and identify how to develop and monetise services that do not rely on screens; a whole new world of audible applications will develop alongside, presenting digital enhancement of the soundscape that will benefit both conventional users and the hearing-impaired.

There are other advantages to introducing cellular connectivity into hearables. Following the tethered route means that OEMs are forced into using technologies owned by the leading handset and cloud-based service vendors, such as Amazon, Baidu, Google, Apple, Huawei and Samsung. This potentially thwarts development of bespoke hearable ecosystems, plus the tie-in with third parties means that product differentiation could remain elusive, especially when it comes to designing application-focussed hearables.

No doubt the gatekeepers of the technology will attempt to widen their ecosystems to accommodate hearables and maintain control. However, those OEMs building standalone products capable of direct access to the Internet, rather than via an attached smartphone, will remove any restrictions entirely. We shall be examining closely how this potential conflict develops.

The market for hearables is about to flourish and the opportunity exists for OEMs to develop standalone hearables offering true differentiation. We anticipate future hearables will include cellular connectivity, thereby creating a truly unique and monetizable product category offering consumers valuable new capabilities.

Comment on this article below or via Twitter @IoTGN