Vodafone, Telefonica, DT IoT and Verizon top Transforma Insights CSP IoT rankings

Matt Hatton of Transforma Insights

Transforma Insights has revealed the results of its analysis of the Internet of Things (IoT) strategies of 10 connectivity providers across technical, geographical and vertical capabilities.

Today the UK-based analyst firm published the report ŌĆśCommunications Service Providers IoT Peer Benchmarking 2020ŌĆÖ as part of its Advisory Service subscription. The report is based on detailed analysis of the strategies of the 10 Communication Service Providers (CSPs) across a diverse range of capabilities in IoT across three categories: technical, geographical and vertical.

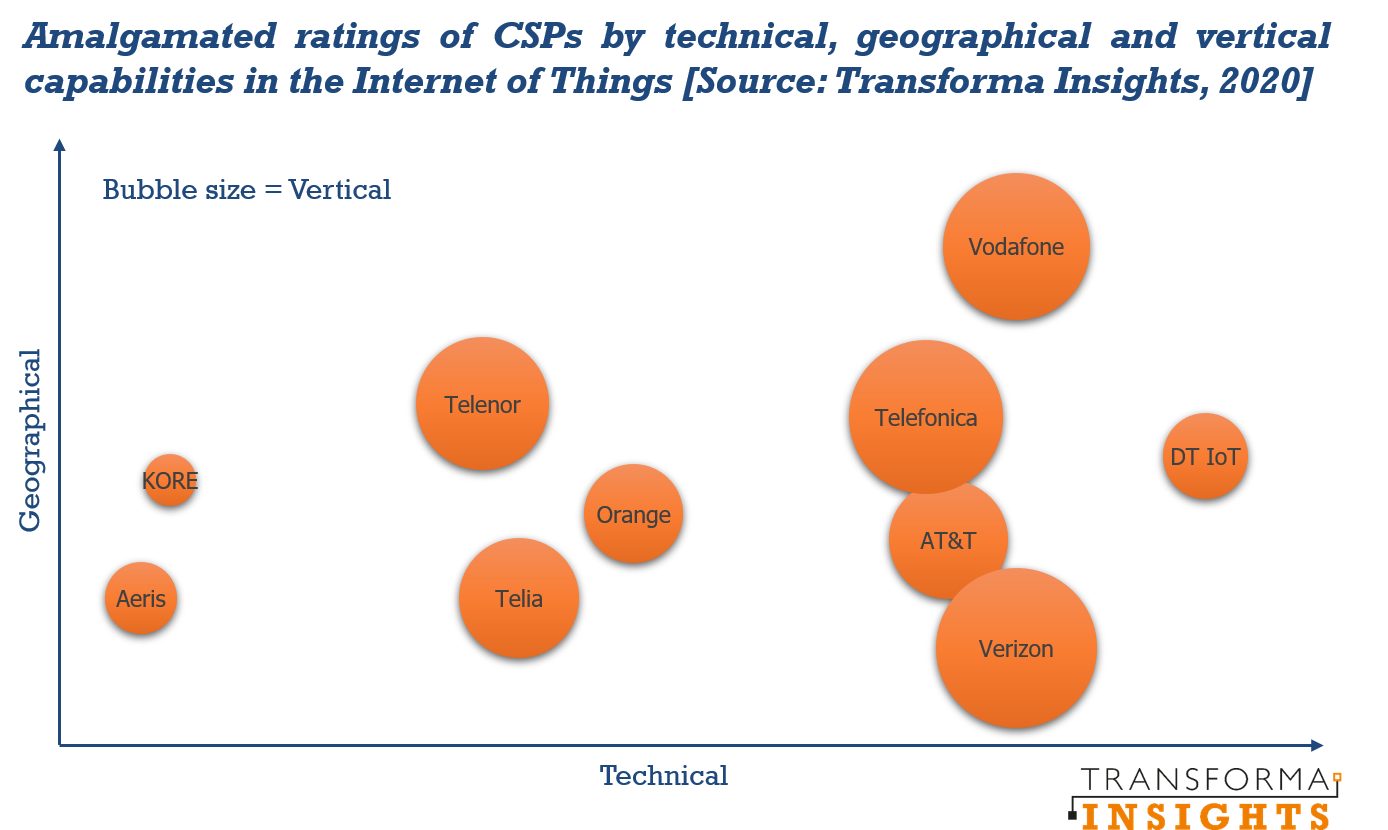

In terms of having a broad span of technical capabilities extending beyond the pure connectivity, the newly established Deutsche Telekom IoT unit DT IoT scores highest, due in part to its strong showing in data management through its Data Intelligence Hub and its systems integration capability with T-Systems.

In terms of verticals, Verizon takes top spot courtesy of a strong transportation offering.

The final criteria, that of geographical scale, is probably more relevant for real-world deployments. On this measure Vodafone is a clear winner. Overall Vodafone comes out with the highest ranking. We would also single out Telefonica as having a strong position across each of the categories, although not topping the chart for any specific one.

Commenting on the results, author Matt Hatton says: ŌĆ£We would like to congratulate all of our top tier of providers. Each of them is a good choice for an IoT buyer. The key thing to remember is that the right answer for who to select will depend on the specifics of the implementation. The rankings are, of course, interesting, but the main aim of the report is to identify best practice in many different areas, which will allow a buyer to pick an appropriate provider for them given their particular requirementsŌĆØ.

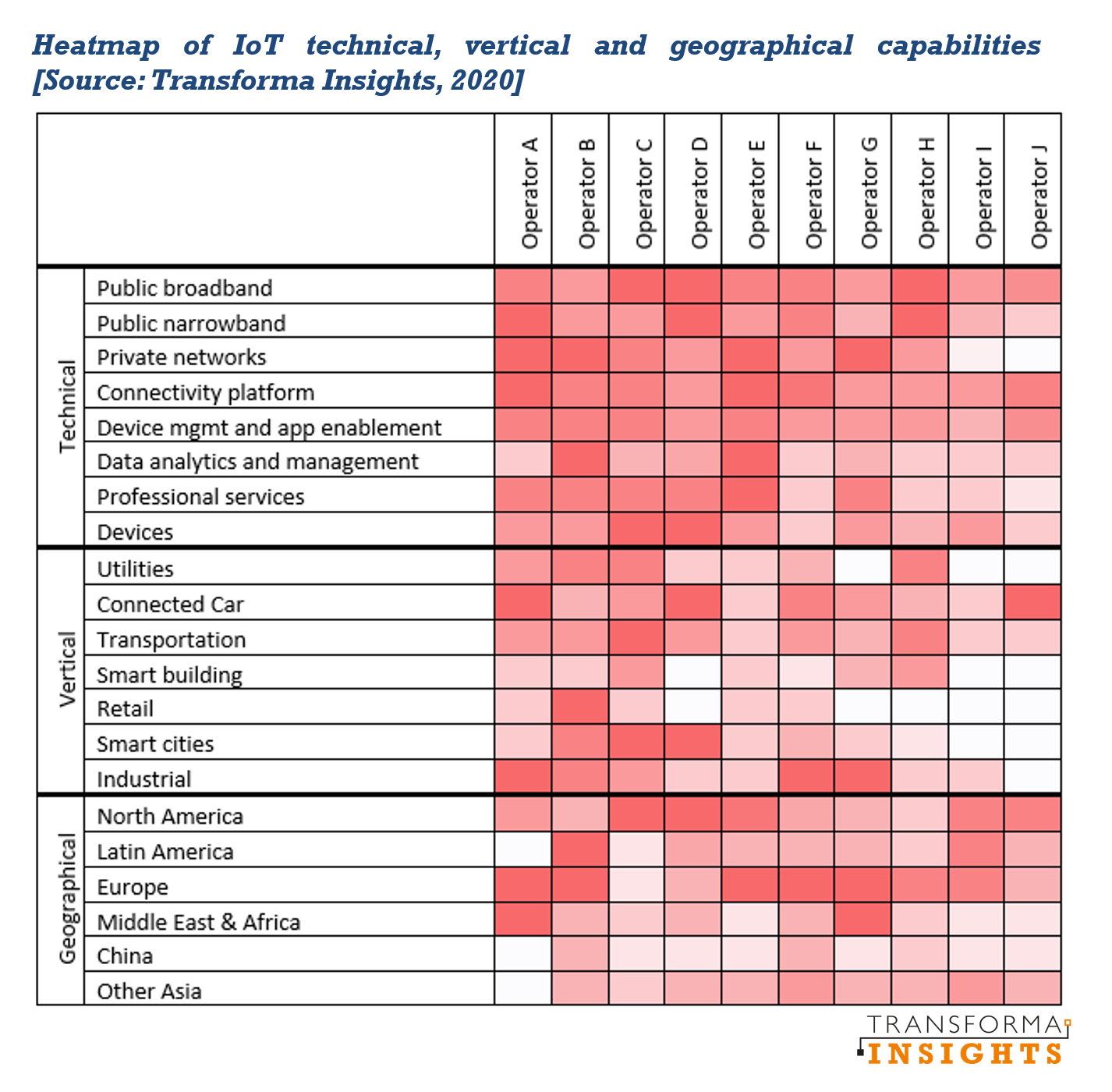

The report includes detailed analysis of approach and capabilities in dozens of areas, which is synthesised into a heatmap comparison of the capabilities of the 10 CSPs across eight technical areas, seven verticals and six geographies (as illustrated in the heatmap below), with weightings applied to each to reach the final rankings.

The findings of the research show a lot of diversity of approaches to addressing the market. Hatton further notes: ŌĆ£In the same way that there is no single ŌĆśbestŌĆÖ provider, there is also no single one-size-fits-all best strategy for CSPs in IoT. ItŌĆÖs most important that CSPs pick the right strategic approach for their organisation. Orange, Telenor and Telia all have broadly speaking the ŌĆśrightŌĆÖ approaches for their market positions. And we donŌĆÖt want to belittle KORE or Aeris as virtual network operators. For clients who want no-nonsense connectivity, particularly supporting less experienced users and smaller deployments, they are a great choice.ŌĆØ

The report also reveals some of the key trends affecting the market as a whole, based on the analysis of CSP strategies. Amongst these are an increasing localisation of connectivity, a greater degree of independence for CSP IoT units, the end to the polarisation caused by platform strategy and alliances, and a much more mature approach to addressing verticals.

About the report

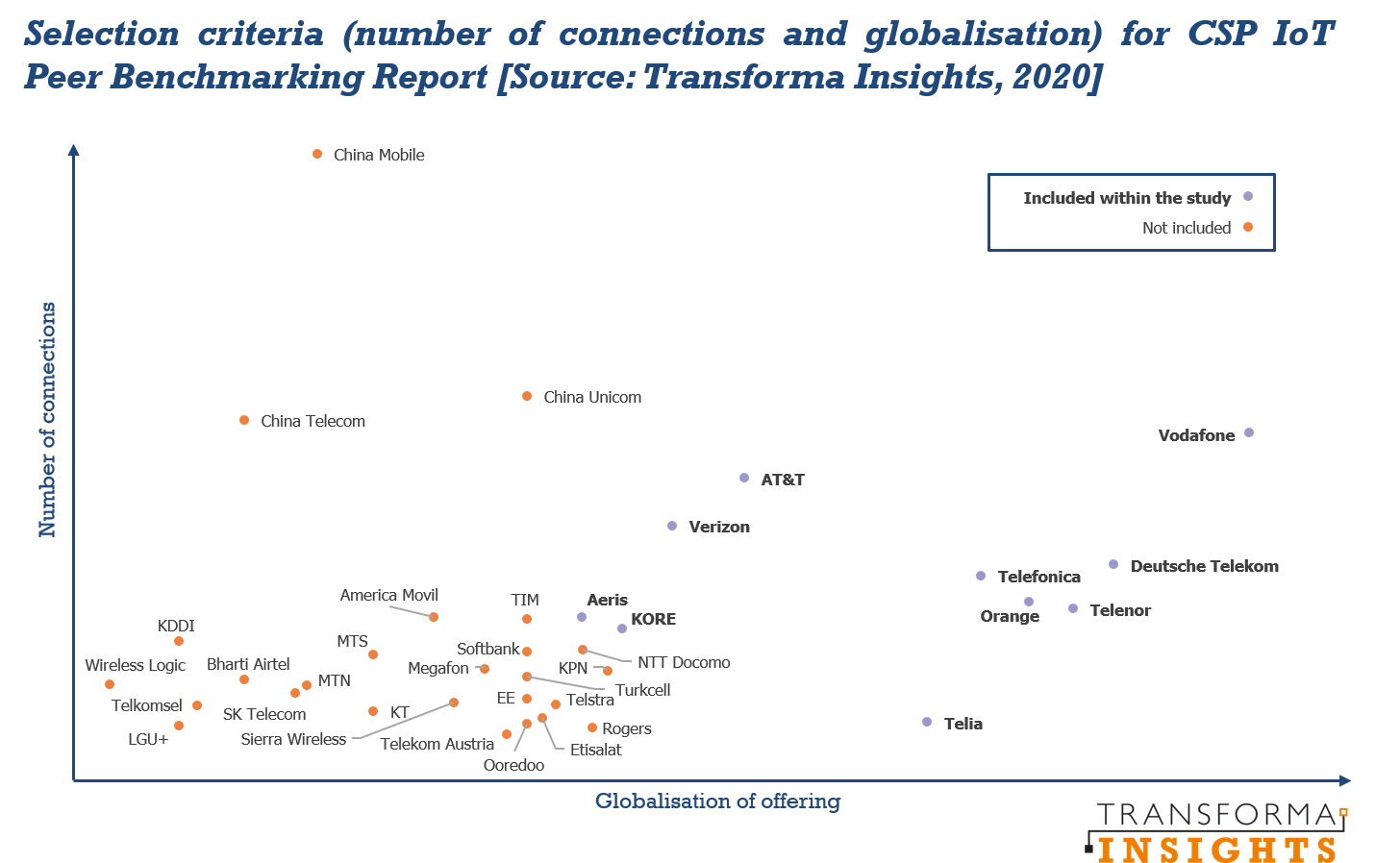

Transforma InsightsŌĆÖ Communications Service Provider (CSP) IoT Peer Benchmarking 2020 report analyses the strategies and capabilities of 10 providers of global IoT connectivity: Aeris Communications,┬ĀAT&T, Deutsche Telekom, KORE, Orange, Telefonica, Telenor, Telia, Verizon and Vodafone. The ten operators chosen are based on an analysis of dozens of operators in terms of scale and globalisation of offering.

The report leads with a comparison of the companies, including aggregated rankings based on the various technical, commercial and geographical capabilities. This is followed by an analysis of the main key trends that have emerged during the research, including analysis of network technologies, organisational structure, commercial and technical relationships and approach to the market.

The majority of the report consists of 3-6 page profiles of each of the companies, featuring sections covering each of the following:

- Background section provides information on the history of the organisation, its structure, size of the team, statistics such as numbers and types of connections, and other salient information.

- Networks section look at capabilities to support connected devices using both public broadband (e.g. LTE and 5G) and narrowband (e.g. NB-IoT or LoRa) networks as well as private networks installed at the customer premises. This includes consideration of how able the CSP is to support connectivity around the world including via partners and alliances.

- Middleware section focuses on a diverse set of platforms and the CSP strategies related to them, most prominently connectivity management, device management, and application enablement.

- Data Management, including hosting, analytics and capabilities associated with post-event data management such as exchanges and trading platforms.

- Solutions and Services covering the approach to addressing vertical sectors either through packaged propositions or through consulting and systems integration.

- Other section which looks at competitive differentiators and capabilities not otherwise considered in the other sections. This includes security and devices.

More details of the report can be found here. The report is available as part of the Transforma Insights ‘Corporate’ package.

Comment on this article below or via┬ĀTwitter @IoTGN