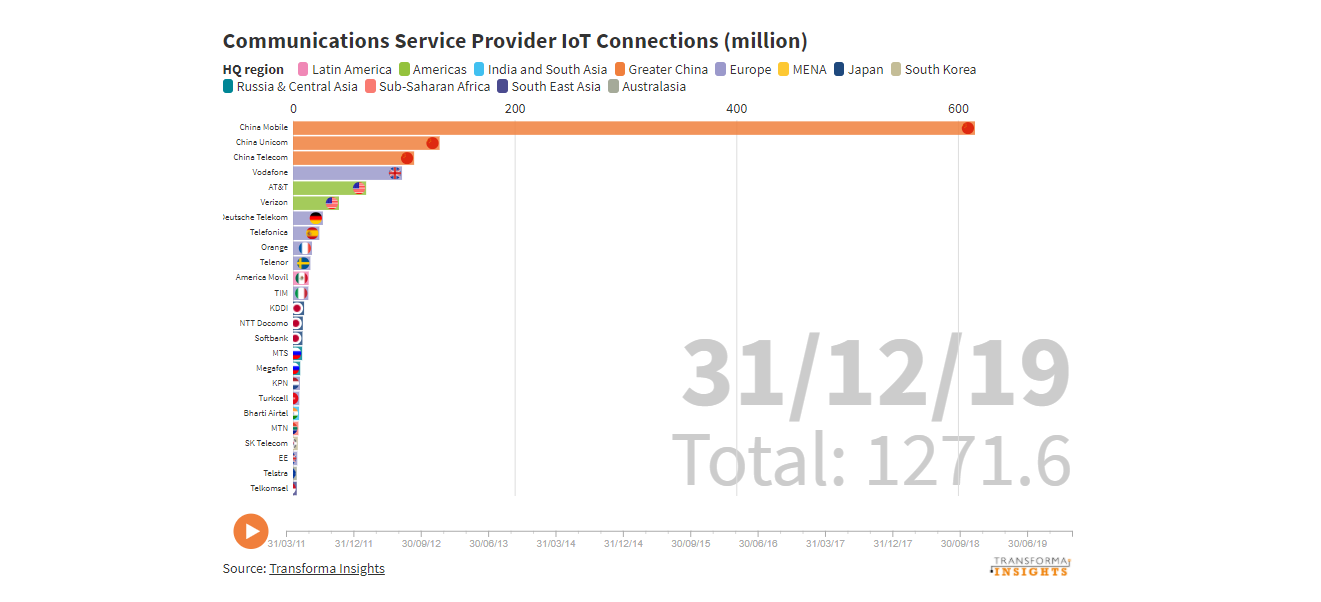

Global top tier of operators account for 1.27bn cellular IoT connections, with China dominant

Ahead of its annual CSP IoT Peer Benchmarking report, Transforma Insights has published a short report tracking numbers of IoT connections for the top 33 carrier groups worldwide.

The 33 communications service provider (CSP) groups worldwide accounted for 1.27 billion cellular Internet of Things (IoT) connections at the end of 2019, up from 948 million at the end of 2018, an increase of 34%, according to new research from Transforma Insights.

The lion’s share of connections is accounted for by Chinese operators, which have 857 million connections, up from 605 at the end of 2018 (42% growth). The other 30 non-Chinese operators that are tracked collectively saw annual growth of 21%, from 343 million to 415 million.

Notably, Transforma Insights has reviewed and revised down the numbers of connections for the Chinese operators compared to their published figures, which were collectively over 1.2 billion at the end of 2019. Commenting on the Transforma Insights approach, report author Matt Hatton says: “There’s little disputing the dominance of the Chinese operators, but the sheer scale of reported figures naturally set alarm bells ringing for our analysts. Based on some further digging we think the real figures for what we would define as IoT connections are about 30% lower than the official stated numbers for IoT connections.”

A graphic illustrating the evolution of the operator connection numbers over the last decade is available on the Transforma Insights website by clicking on the image below.

Another notable trend is the wide divergence in average-revenue-per-connection for the operators around the world. Based on limited available public data the highest was Telia with over US$4.00 (€3.38) per month. The Chinese operators reported only a small fraction of that. Based on China Mobile’s stated connections and revenue figures the average-revenue-per-connection was less than US$0.15 (€0.13) per month.

The findings of the research are published in the report ‘Top 33 operator groups account for 1.27 billion cellular IoT connections with Chinese operators dominant’ which was released today, including numbers of connections for 33 operator groups: America Movil, AT&T, Bharti Airtel, China Mobile, China Telecom, China Unicom, Deutsche Telekom, EE, Etisalat, KDDI, KPN, KT, LGU+, Megafon, MTN, MTS, NTT Docomo, Ooredoo, Orange, Rogers, SK Telecom, Softbank, Swisscom, Telefonica, Telekom Austria, Telenor, Telia, Telkomsel, Telstra, TIM, Turkcell, Verizon, Vodafone.

The research also forms part of the background for the soon-to-be-published ‘Communications Service Provider IoT Peer Benchmarking Report’ which provides detailed analysis of the strategies of ten major connectivity providers: Aeris Communications, AT&T, China Mobile, Deutsche Telekom, Kore Wireless, Orange, Telefonica, Telenor, Telia, Verizon, Vodafone.

According to Hatton: “The analysis of numbers of connections and revenue for the wider group of 33 operators is interesting, but the critical thing for anyone procuring IoT connectivity is which is the right supplier for your needs either vertical, geographical or technical. The best way to determine that is to dig deep into the strategies and capabilities of the carriers, as we have done with a top tier of ten in our CSP IoT Peer Benchmarking Report, which will be published shortly.”

Comment on this article below or via Twitter @IoTGN