Shift in buyer pool as tech giants join the race to own the vehicle of the future, says Hampleton Partners’ report

The first half of 2019 has seen automotive technology deal-making news led by major tech giants challenging traditional OEMs for ‘ownership’ of the vehicles of the future, says Hampleton Partners’ latest report on Automotive Technology M&A (mergers & acquisitions).

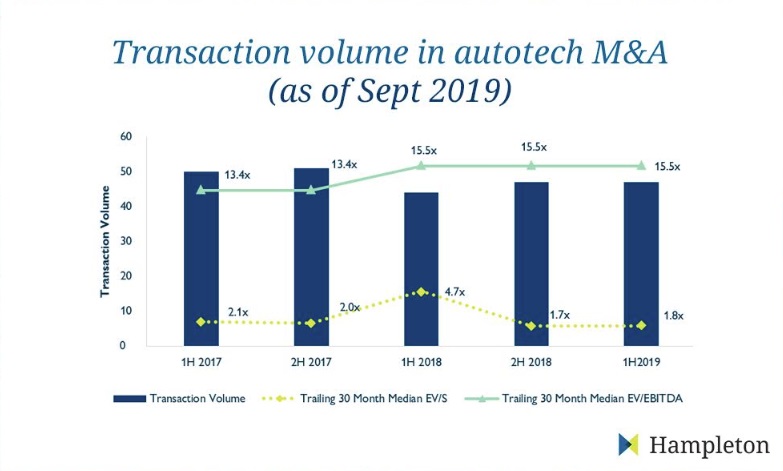

Hampleton Partners, an international technology mergers and acquisitions and corporate finance advisors, noted that deal volumes were stable at just under 50 transactions. In addition, investments by Uber, Amazon and Tesla – plus on-going rumours of Apple’s development of an autonomous vehicle software system – garnered the headlines. Not only did they invest in core automotive technology; they also targeted the supporting industries which will allow autonomous and electric vehicle technology to go mainstream.

Pre-IPO Uber strengthened its geographic reach with the acquisition of Careem for $3.1 billion (€2.8 billion) – the largest autotech deal recorded so far in 2019 (subject to regulatory approval) and an opportunity for Uber to own the digital mobility markets of the Middle East.

Amazon led a US$700 million (€639 million) financing round into electric vehicle start-up, Rivian, to help scale a serious competitor to Tesla. Amazon also participated in the $530m (€484m) funding round into Aurora, a self-driving car technology unicorn.

Meanwhile, Tesla, the pioneer in electric vehicles, acquired additional battery know-how by snapping up Maxwell Technologies to strengthen its leading position in this growth market.

Over the past 30 months, there were 236 active acquirers, with 44 of those making more than one purchase. The most acquisitive companies were KAR Auction Services (five acquisitions), Daimler (five) and Ford (four).

The Hampleton Partners report notes: “The unexceptional transaction volumes conceal a seismic shift in the makeup of investors and buyers in the race to own the vehicle of the future. Now, new faces such as Apple and Uber abound, while Tier 1 suppliers – previously highly active in the space – have reduced their deal-making activity, at least temporarily. In addition, many corporates are hedging their bets earlier by extending their corporate venture capital operations to automotive technology.

“Financial investors are also demonstrating confidence in the viability of the sector and the potential for positive cashflows.”

Other key trends in autotech highlighted by the report include:

- Tire manufacturers have entered the M&A race, as demonstrated by Bridgestone’s acquisition of Tom Tom’s telematics arm for $1 billion (€0.91 bilion) and Michelin’s acquisition of Masternaut, the fleet telematics company.

- Micromobility solutions continue to proliferate in urban environments, as providers receive billion-dollar valuations.

- LIDAR technology: the cost of sensors is decreasing, especially as players are closing large fundraises and the market becomes ever more competitive.

Mobility and fleet management M&A

Mobility and fleet management transactions have boomeranged compared with a slight decline late last year, to reach a record of 17 transactions during 1H2019, with deal sizes notably seeing a boost.

A new entrant into this M&A market segment is I.D.Systems, an American company providing vehicle, container and cargo tracking systems. It acquired the U.S.-based assets of CarrierWeb Services in January and Pointer Telocation to help achieve its strategy of gaining market share in the growing mobile IoT, connected car, and telematics markets.

Automotive technology M&A outlook

The Hampleton Partners report concludes: “Despite clouds on the horizon, namely declining vehicle sales in several key markets, we do not anticipate any slowdown in autotech M&A for the remainder of this year or into early 2020. In fact, we see a bright future for those working in the customer retention and CRM space, as OEM marketing budgets will be searching for great solutions to retain current customers and attract new leads.”

Comment on this article below or via Twitter @IoTGN