SIMalliance reports 5% growth in 2016 global SIM shipments, triple SIM represents more than half

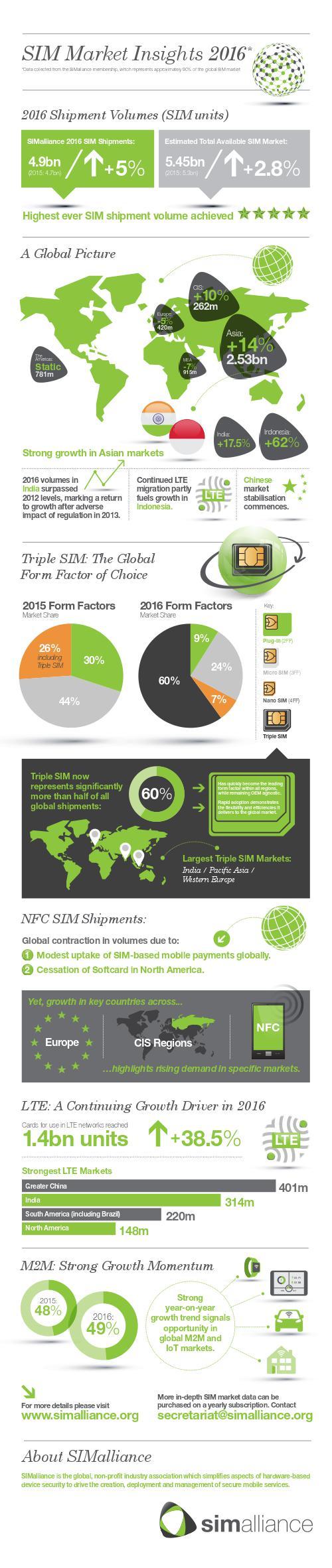

The SIMalliance membership, which represents approximately 90% of the global SIM market, has reported a 5% year-on-year growth in its 2016 shipment volumes. A total 4.9 billion units were shipped during that period.

This is the highest annual volume of shipment units reported yet by the organisation. SIMalliance members estimate that the total available global market for SIM cards also grew in 2016 by 2.8% to 5.45 billion units.

Asia saw the strongest regional growth, with an annual increase in shipments of 14% to 2.53 billion units. Growth was driven by expansion across India, Indonesia and Pacific Asia. In India, the emergence of a new mobile network operator (MNO), together with ongoing LTE launches, contributed to 960 million units being shipped, reflecting a 17.5% increase on 2015 volumes.

This also marks an increase on 2012 volumes in India, signalling that the market has moved back to positive growth following the adverse impact of government regulation on volumes in 2013. In Indonesia, a 62% increase was partly fuelled by continued LTE migration across the region.

Despite the continuation of adverse economic conditions and the ongoing impact of regulation, volumes in China have begun to stabilise following a contraction which started in 2015. Shipments across technologically advanced Japan/Korea remained stable.

Across the Americas, the market remained static, with total shipments of 781 million units. While regulatory and economic challenges continued to affect Brazil, total South America volumes rose by 1.5%, buoyed by growth in other countries.

Shipment volumes in the Commonwealth of Independent States (CIS) grew by 10% to 262 million units. Russia / Ukraine saw a 20% shipment increase, thanks to a degree of recovery from both political uncertainty and depressed oil prices in recent years.

A 5% contraction in volumes across Europe, to 420 million units, is attributed to MNO consolidation across the region. High levels of smartphone penetration and subscriber acquisition have kept shipments in the region stable in recent years.

Globally, there was significant demand for Triple SIM products in 2016, with this form factor category now representing significantly more than half of all global shipments. SIM vendors introduced the Triple SIM in 2013/14, in response to market requirements for a more efficient supply chain.

Its rise to become the form factor of choice in such a short time period, while remaining OEM agnostic, is indicative of the value its flexibility delivers to the market.

Migration to 4G networks continued to be a key market driver throughout 2016 and global shipments of cards that can be used in LTE networks rose by 38.5% to 1.4 billion units. Growth was evident in all regions, with the exception of CIS, where demand remained steady.

Steffen Frenck

Greater China remained the largest LTE SIM card market with 401 million units. India became the second largest market with a significant increase from 62 million units in 2015 to 314 million units in 2016. South America, including Brazil, was the third largest market (220 million units), followed by North America (148 million units).

While the global NFC picture is of an expanding ecosystem, consumer uptake of SIM-based mobile payments has been lower than anticipated in recent years. This has led to a contraction of NFC SIM shipments in 2016. In addition, the impact of the cessation of Softcard in North America was still being felt in 2016.

Growth of NFC SIM shipments in key countries across Europe and CIS regions, however, highlights that there is rising demand for this type of product in specific markets.

A 49% increase in shipments of embedded SIMs (soldered) designed specifically for M2M applications (M2M MFF2) was driven by growing demand in the Americas, Asia and Europe. This year-on-year growth trend demonstrates future growth opportunities in the global M2M market, particularly within the automotive and energy / utilities sectors.

Steffen Frenck, SIMalliance board member, commented: “The data released today by SIMalliance is very good news indeed and evidences increasing demand for UICC / SIM-based products and solutions across established use cases, and also emerging markets such as M2M and IoT.

SIMalliance members are also responding to new opportunities following the GSMA’s publication of remote subscription management specifications last year. Despite ongoing economic issues and regulatory challenges faced by some regions, SIMalliance member shipments in 2016 grew by more than 200 million units, or 5%, to the highest level ever reported. The total available market also showed robust growth.

Strong performance in Asia reflects sustained demand for cards for LTE networks due to the rollout of 4G networks, and India’s continued growth suggests long-term market resilience to economic and regulatory pressures. In parallel, the rapid emergence of Triple SIM as the form factor of choice is testament to the efficiencies it delivers and demonstrates the SIM industry’s responsiveness to the evolving requirements of the global market.

“As the world becomes increasingly connected, the need to secure devices to protect services, digital assets and the identity of individuals will become ever greater,” Frenck added. “SIMalliance and its members will continue to drive innovation to deliver comprehensive security for a broad range of use cases, across different device types.

With a standardised, global security infrastructure already in place, alongside an established process landscape, the SIM industry offers an instant solution to many challenges associated with bringing secure mobile services to market, and managing them remotely.

This applies regardless of the device form factor or use case. In line with the exponential growth of M2M and IoT deployments SIMalliance will continue to collaborate with a wide-range of industry stakeholders to ensure that new use cases and business models can be simply and securely supported.”

In China, LTE cards shipped were localised solutions based on regional standards.

Comment on this article below or via Twitter @IoTGN