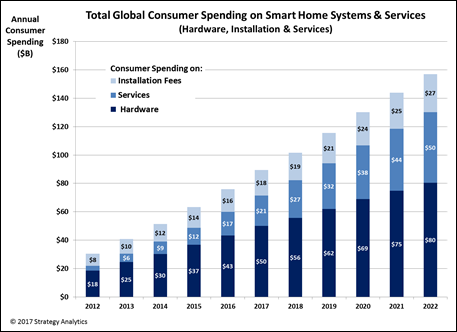

Global consumer smart home spending to grow to $158bn by 2022 from $76bn in 2016, says Strategy Analytics

Bill Ablondi of Strategy Analytics

Strategy Analytics has released its “State of the Smart Home Market: 1Q 2017” report citing a period of competitive turbulence as new vendors vie for position in the burgeoning market.

Business models are in flux as service providers seek sustainable revenues other than for security monitoring and smart home platforms are seen as critical for differentiation. To maintain control of key features and enhancements some firms have built platforms in-house (e.g., Lowe’s, Vivint) or acquired platform developers (AT&T, British Gas, Eneco); others such as Dixons Carphone, Telefonica, KPN, O2, Orange and Securitas have licensed platforms from Zonoff , Huawei, Qivicon, AT&T, MiOS and Alarm.com respectively.

Key findings include:

- Elegantly designed devices will become part of “Connected Integrated Systems”. Device manufacturers need to create an ecosystem such as Apple is doing with HomeKit or join one.

- Developing a recurring revenue business model is a key factor for success. Cross-industry partnerships are essential to building compelling value added services.

- Offering professional installation for smart home services ensures higher customer satisfaction.

“Our user experience research confirms that consumers don’t want multiple apps on a smartphone to manage multiple smart home devices,” states Bill Ablondi, director in Strategy Analytics Intelligent Home Group and co-author of the study. “One-off devices will remain a significant portion of the market, but a unified software platform managing all the devices in the home as a system – an Intelligent Home System — is where we see the market going.”

Predictions for 2017 include:

- Business models monetising data collected by smart home devices will emerge

- Bluetooth Mesh emerges and coupled with Bluetooth 5 capabilities threatens ZigBee, Z-Wave and Thread

- The move away from the smartphone as the primary interface for the home will continue in 2017

Consumer spending on smart home services will nearly triple on a global basis from $17 billion in 2016 to $50 billion in 2022.

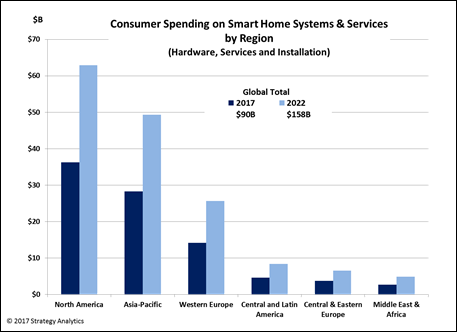

North America to remain the largest market over the forecast period, but China is driving growth in Asia-Pacific region.

Comment on this article below or via Twitter @IoTGN