Car poised to be CE’s ‘Fifth Screen’

As consumer attitudes to car ownership and driving begin to shift and technology companies shape the roadmap for autonomous vehicles, the global in-car entertainment (ICE) hardware market is on track to reach US$36 billion by 2021. This is according to a new connected car report from Futuresource Consulting.

“The lines between couch and car are beginning to blur,” says James Manning Smith, research analyst at Futuresource Consulting. “The buzz surrounding ICE has been getting louder for some time and what we regard as conventional in-car entertainment continues to alter. We’re fast approaching a new landscape where our thinking will be redefined.”

As ride-sharing and car-sharing become more popular, people are spending less time driving and more time-consuming entertainment and media in the car. Better ICE systems are allowing the integration of personal mobile devices, leading to even greater device usage in the car through both smartphones and tablets.

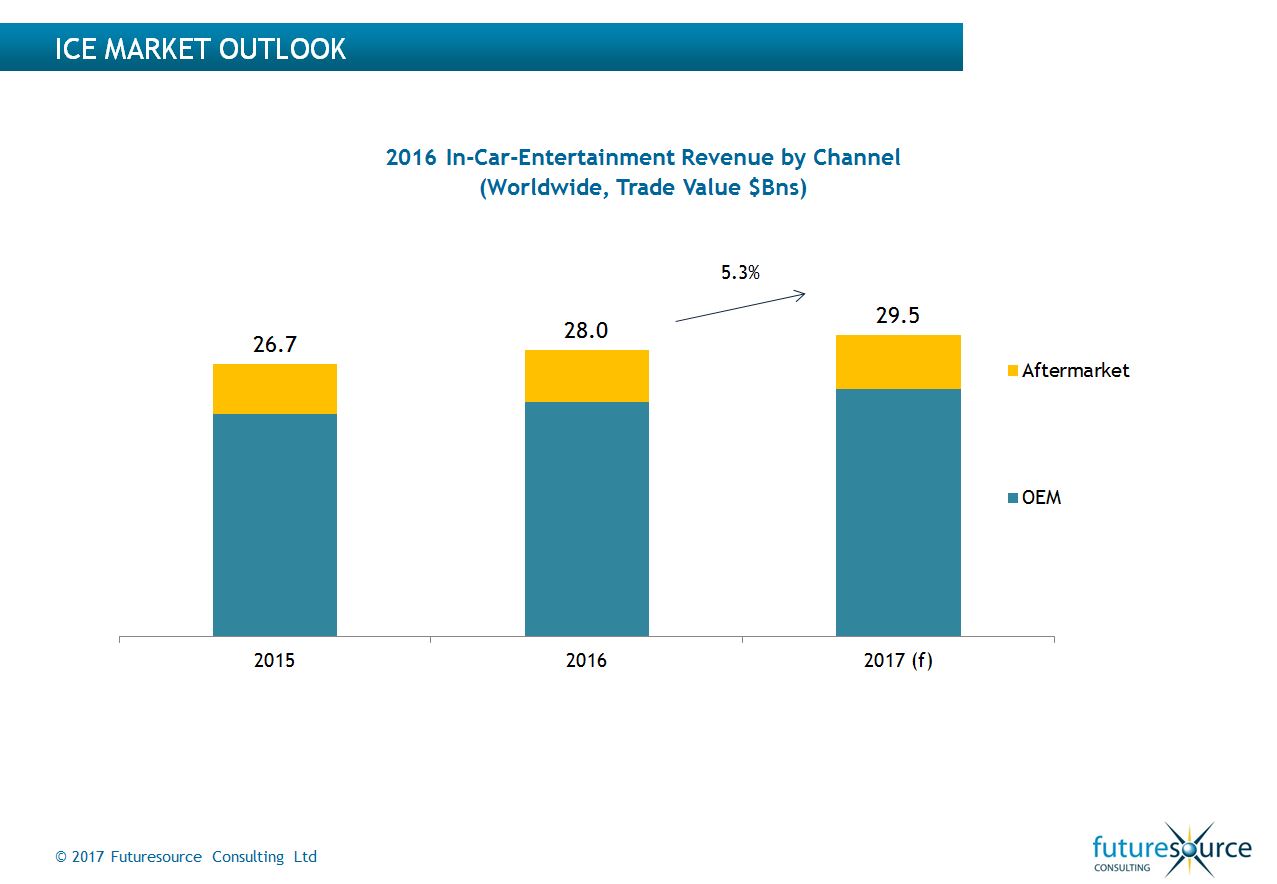

More and better screens, in the driver console and for rear seat passengers, greater availability of in-car connectivity and Wi-Fi services, and the development of Apple CarPlay and Google/ Android Auto are all playing their part in growing the ICE market from $28 billion in 2016 to $36 billion in 2021.

“Driving will require less human input or no input at all, and there is a greater opportunity to make use of travel as leisure time,” says Simon Bryant, associate director at Futuresource Consulting. “We’re going to see the car repositioned as an entertainment provider for its occupants, rather than just a means of transport.

Personal devices will work seamlessly when in the car, altering environment and driving preferences based on the driver. Our transportation will become connected to our homes, our cities, our smartphones and other personal electronic devices, and our lives will seamlessly transition to each environment.”

Rising connectivity levels, the driverless experience and increasing car numbers are all benefiting ICE hardware and service providers. Futuresource forecasts that connected cars will grow from 30 million vehicles globally at the end of 2016 to more than 200 million by 2020. That will grow the value of connected packages (telematics, infotainment and safety) to more than $100 billion in the same timeframe.

“Watch out for the proliferation of concierge services such as on-demand petrol delivery and filling at your home, mobile payments for tolls and petrol, usage-based insurance and smart parking,” said Bryant.

“Driver and passenger personalisation is going to get smart through cloud services. Voice, gesture and motion control will be commonplace, as will augmented reality, biofeedback and integration with wearables and the smart home. Human-machine interface (HMI) systems – the stuff of science fiction – are now sliding into the driving seat.”

By 2020, electric and hybrid vehicles are forecast to represent 10% of car manufacture, a trend that will disrupt the competitive landscape with entrants like Tesla, Google, Faraday Future, and even Apple developing cars for mass production.

Although more dramatic shifts in personal transport are expected, autonomous driving will not have a significant impact within the forecast period. Futuresource expects autonomous vehicles to reach consumer markets by 2020, with production rising to approximately 10% of all vehicles by 2035.

“As the car takes on a role as the fifth screen, the likes of Apple – seeing flattening demand for its mobile offering – and Samsung – with its recent purchase of Harman, will enter the automotive land grab in earnest,” says Bryant. “Keep an eye on the Dreamworks Honda collaboration and watch out for Netflix, Twentieth Century Fox and Warner Brothers all going after a piece of the action.”

Comment on this article below or via Twitter @IoTGN